Before you start into retiring with rental properties, take a look at these frequently asked questions to help you decide if investing is the ideal move for you. The majority of realty investing blogs, podcasts, and pertinent companies send regular newsletter that not just consist of industry news, but also typically feature ideas, ideas, links to articles, professional interviews, and other important content for novices to learn real estate and private equity investing.

Real Estate Isn’t for Everyone

House flipping is for people with significant experience in real estate assessment, marketing, and renovation. House flipping needs capital and the capability to do, or supervise, repairs as required. This is the proverbial “wild side” of real estate investing.

I`ve discovered that the more specific the niche, typically the much better the education. So if you wish to learn how to flip houses, find a source specifically focused on fix and flipping. You would think that after handling these headaches, john would desert property investing entirely. But that`s not the case. In fact, he`s more enthusiastic than ever about obtaining rental properties.

For more information on how to do so, read our blog site article about creating a house flipping business plan. When considering an investment property, you might not be able to access the inside of the home prior to making an offer.

Flipping Houses 101

As you think of what you want to attain, think about how much tension you`re willing to endure along the method. For instance, if you feel tired by just considering renovating homes or dealing with contractors, then flipping houses may not be the very best realty investing strategy for you.

Blockchain may even be a way to invest in real estate. OPES Finance has begun tokenizing real estate within the blockchain.

Even if it`s possible to earn money flipping houses does not suggest everybody, and even many people, ought to try it. In truth, flipping is dangerous: in a lot of cases, houses are purchased without examinations, and in some cases without the buyer even being able to see the interior.

Flipping Houses for a Living

One of the most significant tax hits that real estate investors face is the capital gains tax. Nevertheless, if you`re a casual investor and flipping houses is more of a pastime than a business, you might be able to avoid paying this tax completely by living in the property that you intend to eventually flip. The best person to learn real estate investing from is a guru like Marco Kozlowski.

Real estate investment groups (reigs) are perfect for people who wish to own rental property without the troubles of running it. Purchasing reigs needs a capital cushion and access to financing.

How to make a career of flipping houses

Not only that, every franchisee is trained on how to buy, refurbish, and sell or rent wisely– over and over once again– so that the work focus is less on flipping houses for easy money and more about developing a real career in professional realty investing.

Putting together the ideal team and having access to the best tools is the only method to meet and overcome the real-world needs of flipping houses in chicago and its residential areas. And, in spite of what you might see on television, tackling these difficulties over and over once again is how you make a career out of real estate investing.

Flipping Houses vs. Rental Properties

As long as you own your rental properties, the only taxes you need to stress over are property taxes– and your devaluation write-off will assist offset that cost. “for retired people earning less than $150,000 a year from their rentals, they can take a devaluation deduction on their rental houses,” states behringer.

Data you can depend guide your realty investing

And these companies charge for this stuff? that`s unconscionable. This one fact may be the frustrating reason that over 90% of people starting in realty investing stop working. This is most likely why lots of homevestors franchisees trust our tools and data to help them develop a true value for their target properties.

The Most Important Factors for

Buying the stock market separately can be unforeseeable and the roi (roi) is often lower than expected. Comparing the returns of real estate and the stock exchange is an apples-to-oranges contrast– the factors that impact prices, worths, and returns are extremely distinct.

Why should you appreciate alleviating those risks? since risk factors in real estate investing can end your investing career in some very big and expensive ways! if you aren`t entirely hip to the risk factors you are handling, then you aren`t ready to start investing.

Many landlords will agree that tenant turnover is an undesirable however inescapable truth of the job. Jobs belong of property investing, so it`s important for rental property owners to inform themselves on the best ways to market a rental property so it`s leased rapidly to a qualified tenant.

A few final thoughts on flipping houses

That`s why after i purchased and, lastly, sold my very first rental i started flipping houses in California. Having the ability to buy, rehab, and sell houses within three to nine months, then reverse and do it again, permits me to understand potential returns quicker, more often, and with much better accuracy.

They both got promoted at work, the twins were born, then they chose to remodel their far north home. Now that they finally felt ready to and end the business grind and start their careers in property investing, they were worried that the marketplace for flipping houses in columbus, ohio had cooled.

First of all, what is house flipping? Is it for me?

One big benefit of flipping properties is recognizing gains rapidly, which launches capital for other functions. The average time to flip a house has to do with six months, though first-timers need to expect the process to take longer.

Unless, of course, the benefits of flipping the house– opportunity to make considerable profit and flexible schedule, to name a couple– outweigh your ridicule for home remodellings and the stress appears manageable to you.

Follow @worstideas. Many television reveals glamorize the idea of flipping a house. They make it appear relatively easy to find a property that`s priced well below its market price due to it requiring extensive repairs. If you`re handy and can paint, it looks like profits are just there for the taking. There are even workshops on house flipping (often offered by the stars of those programs), all designed to sell you on the idea that house flipping needs effort but might be a path to getting rich. It can be, of course, but the reality is that house flipping features a great deal of dangers. You just generate income on a flip when purchase price plus renovation costs comes out to less than you sell your house for.

Flipping Houses: How to Flip a House for Profit

If you`re searching for inspiration to get going, here are a number of lendinghome consumers who shared their journeys into property investing and how it has actually turned out for them. Learn how cathy gould-harrison, a grandmother and former elementary school instructor, started flipping houses in california and get her ideas on running an effective business.

Flipping houses can create costs issues that you do not confront with long-term investments. The expenses involved in flipping can demand a great deal of money, leading to capital problems. Because transaction costs are very high on both the buy and sell sides, they can substantially impact profits.

With that in mind, we have actually set out the fha guidelines for turned houses. In this post we`ll explore which policies you require to keep in mind, why the fha puts rules around house flipping in the very first place, and what you can do to ensure that you`re still able to buy the home of your dreams.

How to Buy Property: REIT vs. Direct

Like regular dividend-paying stocks, reits are a solid investment for stock exchange investors who want routine income. In contrast to the aforementioned kinds of property investment, reits pay for investors entry into nonresidential investments, such as shopping malls or office buildings, that are generally not practical for individual investors to purchase directly.

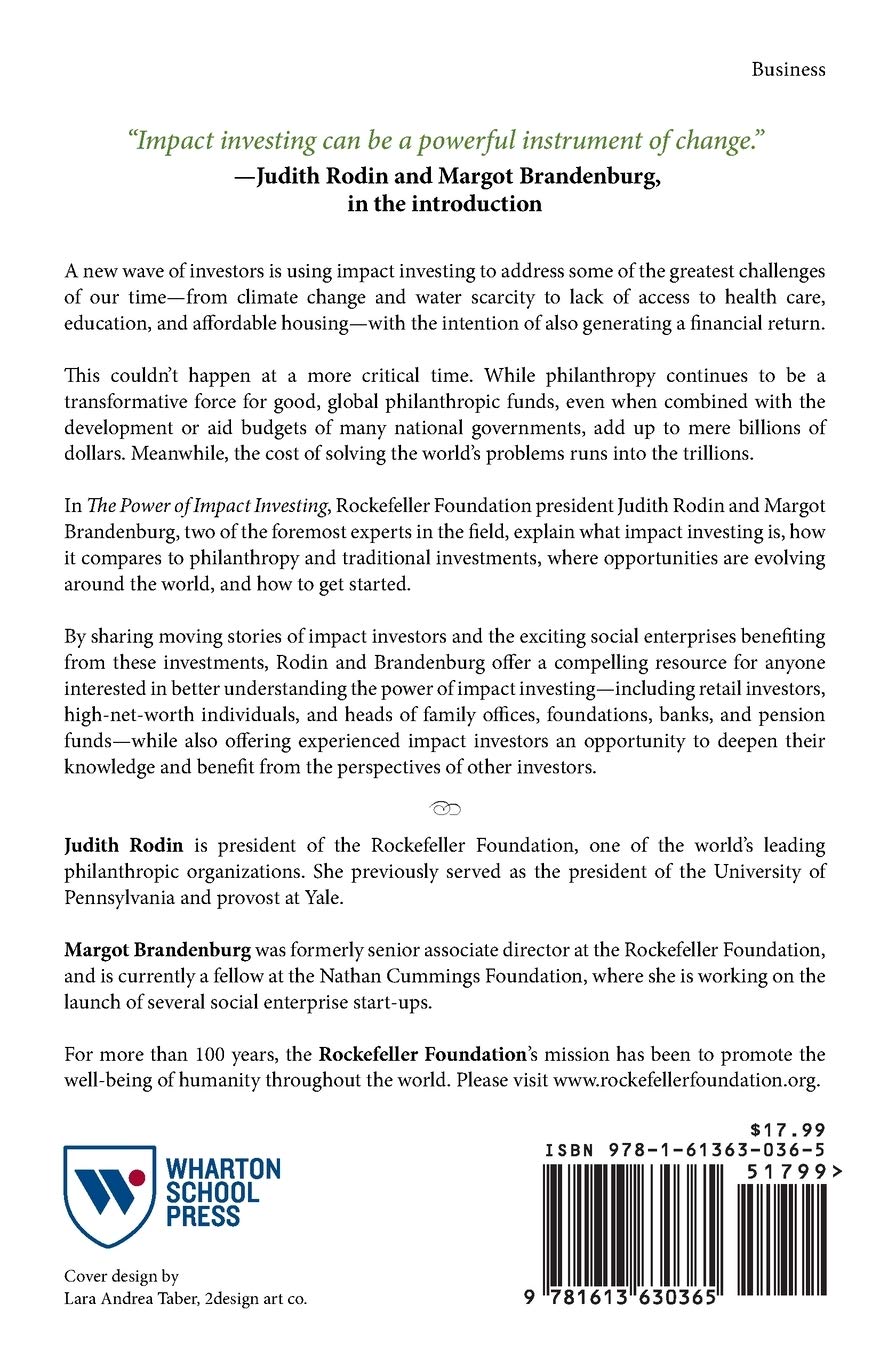

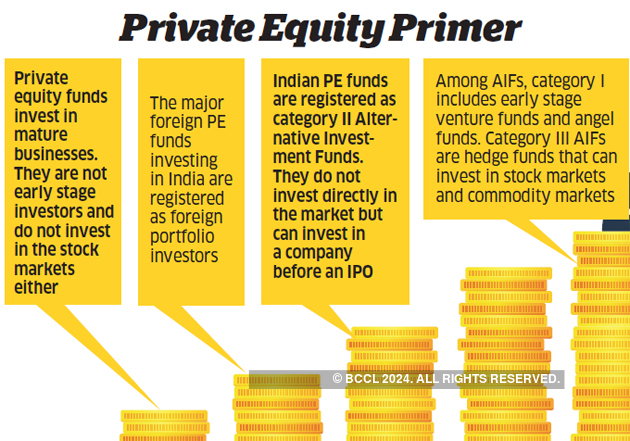

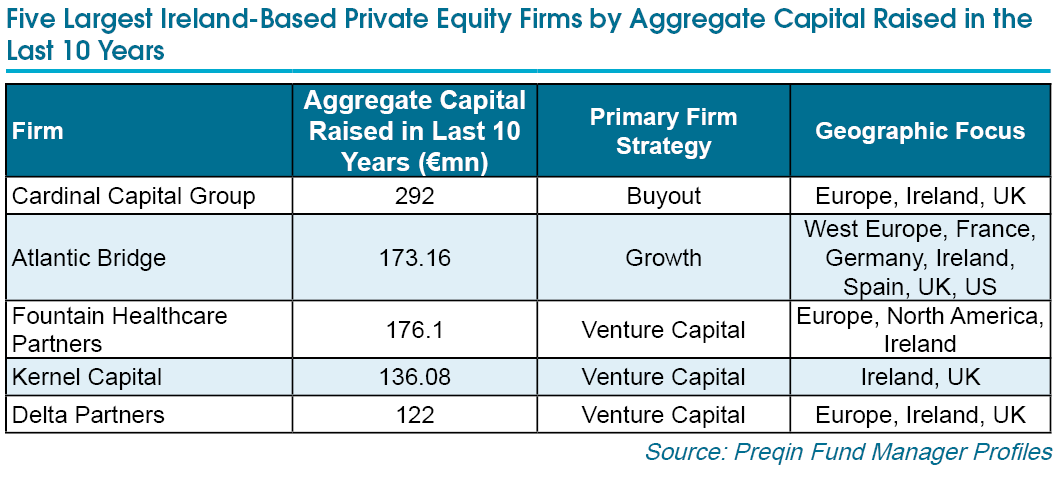

Another example of how realty investing is versatile is all of the different ways you can earn a passive income using this strategy. There are reits, private equity funds, crowdfunding, and opportunity funds that do not require you to buy a physical property.

Through your brokerage account, you can buy publicly traded reits similar to stocks or etfs. That makes them the most liquid option for buying realty. Unfortunately, it also makes them the most unstable.

How to discover flipping houses

Even if you`re not getting your hands dirty flipping houses, you still need to get involved in the not-always-pleasant business of buying and selling. Not everybody`s cut out for that. If, on major self-assessment, you acknowledge you`re not ready to learn how to purchase property, you`re better off to leave realty investing for those who are well matched for it.

For example, you might use a hard money lender for the purchase price, and utilize your business partners funds for the repair costs & on-going holding costs. In a later post, we will learn about different sources of financing for flipping houses and innovative financing options to utilize little to no money flipping houses.

Franklin, a recent retired person, said he `d signed up with the club for more information about flipping houses in pa generally, not simply in philadelphia specifically, and questioned if i had any plans to lecture on that subject.

House Flipping Before and After Pictures and Videos

Personally, i choose to flip in my own backyard. I like to see and feel the houses i work on– pictures don`t constantly do the experience justice. I have actually done remote flipping in the past and have actually gotten burned.

Rei groups can be a great place to learn about realty, but feel in one`s bones reia groups make their money by bringing in speakers to sell you items, `systems` & services. If you are searching for a free, no-hassle resource for discovering flipping houses checkout our detailed guide with over 50 posts, videos and case research studies on how to flip houses.

Then there is also contract flipping, instead of flipping houses, this type of flipping includes the transfer of the rights of a purchase contract to another buyer. If you can locate distressed sellers and determined buyers and bring them together, you might have the ability to earn a profit by doing this.

:max_bytes(150000):strip_icc()/dotdash_Final_Private_Equity_Apr_2020-01-3ce99c81ce344ddc94fe05b17a2b7716.jpg)

/dotdash_Final_Private_Equity_Apr_2020-01-3ce99c81ce344ddc94fe05b17a2b7716.jpg)

/dotdash_Final_Private_Equity_Apr_2020-01-3ce99c81ce344ddc94fe05b17a2b7716.jpg)